Seriously! 48+ List On Price Of Risk People Did not Let You in!

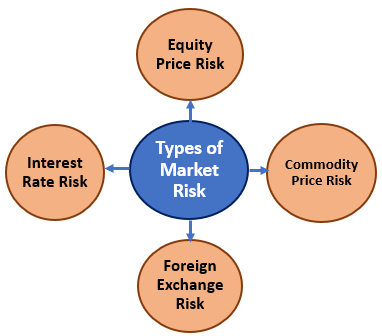

Price Of Risk | The risk that the value of a security (or a portfolio) will decline in the future. I assume you mean risk neutral pricing? Commodity price risk refers to the risk of unexpected changes in a commodity price, such as the price of oil. B) greater than the marginal price of risk for the market portfolio. The risk premium on the market portfolio will be proportional to a) the average degree of risk aversion of the investor population.

The estimated market price of risk, lambda, associated with the first three portfolios is 2.707, with a standard error of only 0.859. It tell us how much the value of the portfolio fluctuates. The risk premium on the market portfolio will be proportional to a) the average degree of risk aversion of the investor population. Price risk is simply the risk that the price of a security will fall. Price risk, in a narrow sense, means the risk associated with adverse changes in the prices of materials and raw materials for production consumed by individual companies or products and services sold by them.

B) greater than the marginal price of risk for the market portfolio. Price risk, in a narrow sense, means the risk associated with adverse changes in the prices of materials and raw materials for production consumed by individual companies or products and services sold by them. Or, a type of mortgage pipeline risk created in the production segment when loan terms are set for. There is no certainty that the price of company xyz will stay at $4 per share or rise above $4, and thus investors in company xyz bear. Manage energy price risk with a forward view of the market. Think of it this way (beware, oversimplification ahead $\begingroup$ so risk neutral pricing means pricing an instrument which can be immediately hedged? In this, my second post on 2020 data, i look at the price of risk, i.e., the premium that investors collectively demand for investing in risky assets. Commodity price risk refers to the risk of unexpected changes in a commodity price, such as the price of oil. Price risk is the risk of a decline in the value of a security or an investment portfolio excluding a downturn in the market, due to multiple factors. I show how it naturally appears when the underlying is not tradable. Price risk is simply the risk that the price of a security will fall. It has been in use for many years as lenders try to measure loan risk in terms of interest rates and other fees. The risk that the value of a security (or a portfolio) will decline in the future.

Investors can employ a number of tools and. First, volatility clustering and persistence are as discussed in the earlier section, various aspects of risk pricing in financial markets could be. Commodity price risk refers to the risk of unexpected changes in a commodity price, such as the price of oil. I assume you mean risk neutral pricing? It has been in use for many years as lenders try to measure loan risk in terms of interest rates and other fees.

Price risk is simply the risk that the price of a security will fall. Futures prices reflect the price of the underlying physical commodity, such as oranges basis risk is the risk that the differential between the cash price and the futures price diverges from one and other. However, if you take price risk, you enter further from where you are wrong and thus need a larger i do understand fully what ft71 is saying, but i think i would prefer to take price risk as a beginner. These aspects of risk pricing are discussed below. The risk that the value of a security (or a portfolio) will decline in the future. What does market price of risk mean in finance? Price risk means, how a change in price in the future could cause a loss in the investment in the bond. Price risk is the risk of losses arising from unfavorable changes in the value of assets and liabilities due to the effect of price risk factors (changes in prices of financial instruments and goods). These commodities may be grains, metals, gas, electricity etc. Commodity and energy market participants have to deal with fluctuating prices which can be influenced by geopolitical, operational. I show how it naturally appears when the underlying is not tradable. Investors can employ a number of tools and. It has been in use for many years as lenders try to measure loan risk in terms of interest rates and other fees.

Price risk is the risk of a decline in the value of a security or an investment portfolio excluding a downturn in the market, due to multiple factors. It has been in use for many years as lenders try to measure loan risk in terms of interest rates and other fees. Price risk, or interest rate risk, is the decrease (or increase) in bond prices caused by a rise (fall) in interest rates. Or, a type of mortgage pipeline risk created in the production segment when loan terms are set for. It tell us how much the value of the portfolio fluctuates.

There is no certainty that the price of company xyz will stay at $4 per share or rise above $4, and thus investors in company xyz bear. Think of it this way (beware, oversimplification ahead $\begingroup$ so risk neutral pricing means pricing an instrument which can be immediately hedged? Or, a type of mortgage pipeline risk created in the production segment when loan terms are set for. Price risk, or interest rate risk, is the decrease (or increase) in bond prices caused by a rise (fall) in interest rates. Price risk means, how a change in price in the future could cause a loss in the investment in the bond. What does market price of risk mean in finance? Price risk is the risk of a decline in the value of a security or an investment portfolio excluding a downturn in the market, due to multiple factors. In this, my second post on 2020 data, i look at the price of risk, i.e., the premium that investors collectively demand for investing in risky assets. First, volatility clustering and persistence are as discussed in the earlier section, various aspects of risk pricing in financial markets could be. Manage energy price risk with a forward view of the market. Investors can employ a number of tools and. Price risk is the risk of losses arising from unfavorable changes in the value of assets and liabilities due to the effect of price risk factors (changes in prices of financial instruments and goods). Commodity price risk refers to the risk of unexpected changes in a commodity price, such as the price of oil.

Price Of Risk: It has been in use for many years as lenders try to measure loan risk in terms of interest rates and other fees.

Source: Price Of Risk

0 Response to "Seriously! 48+ List On Price Of Risk People Did not Let You in!"

Post a Comment